Double Closing Real Estate: The Ultimate Guide (2026)

Dec 05, 2025

Key Takeaways: Double Closing Real Estate

- What: A strategy where an investor purchases a property (A-B transaction) and immediately resells it to an end buyer (B-C transaction) on the same day.

- Why: It keeps your profit margin private. The original seller never sees how much you are selling the property for.

- How: Unlike a standard assignment, you take legal title for a brief moment using "transactional funding" or flash cash to close the first deal.

What You’ll Learn: The exact step-by-step process to legally close two transactions in one day and protect your wholesale fees.

Imagine this scenario: You just negotiated a killer deal on a distressed property. You locked it up for $200,000. You found a cash buyer willing to pay $240,000. You are poised to make a $40,000 assignment fee.

But when you get to the closing table, the seller looks at the settlement statement. They see your $40,000 fee line item deducted from their equity. They get angry. They feel ripped off. They refuse to sign.

The deal blows up, and you walk away with nothing.

This is the nightmare of double closing real estate prevents. In the competitive world of real estate wholesaling, managing the emotions of sellers is just as important as managing the numbers. While assigning a contract is the fastest way to get paid, it requires total transparency. Everyone sees what everyone gets paid.

A double close (also called a simultaneous closing or back-to-back closing) solves this by creating two entirely separate transactions. You become the actual owner of the property—if only for five minutes—granting you total privacy regarding your profit spread.

However, this strategy is more complex than a simple assignment. It requires specific financing, an investor-friendly title company, and a mastery of the logistics. If you don't have the right systems in place, as we outline in our Ultimate Guide to Start Real Estate Investing, the extra closing costs can eat your entire profit.

This guide will walk you through exactly how to execute a double closing in 2026, ensuring you keep your deals alive and your profits private.

Here is what we will cover:

- What Is A Double Closing? (The Mechanics)

- The Fast Track: Why You Need A System

- How To Double Close In 7 Steps

- Transactional Funding: Wet vs. Dry

- When Should You Double Close?

- Is Double Closing Legal? (2026 Update)

- Frequently Asked Questions

Double Closing protects your fee, but only if the deal is deep enough. If you buy at retail prices, you can't afford to pay closing costs twice. You need off-market inventory with massive equity.

Our FREE Training reveals the exact marketing system we use to find the deep-discount properties that make these back-to-back transactions possible. Stop relying on thin deals.

What Is A Double Closing? (The Mechanics)

A double closing is exactly what it sounds like: two completely separate real estate transactions occurring back-to-back on the same property, usually within hours of each other.

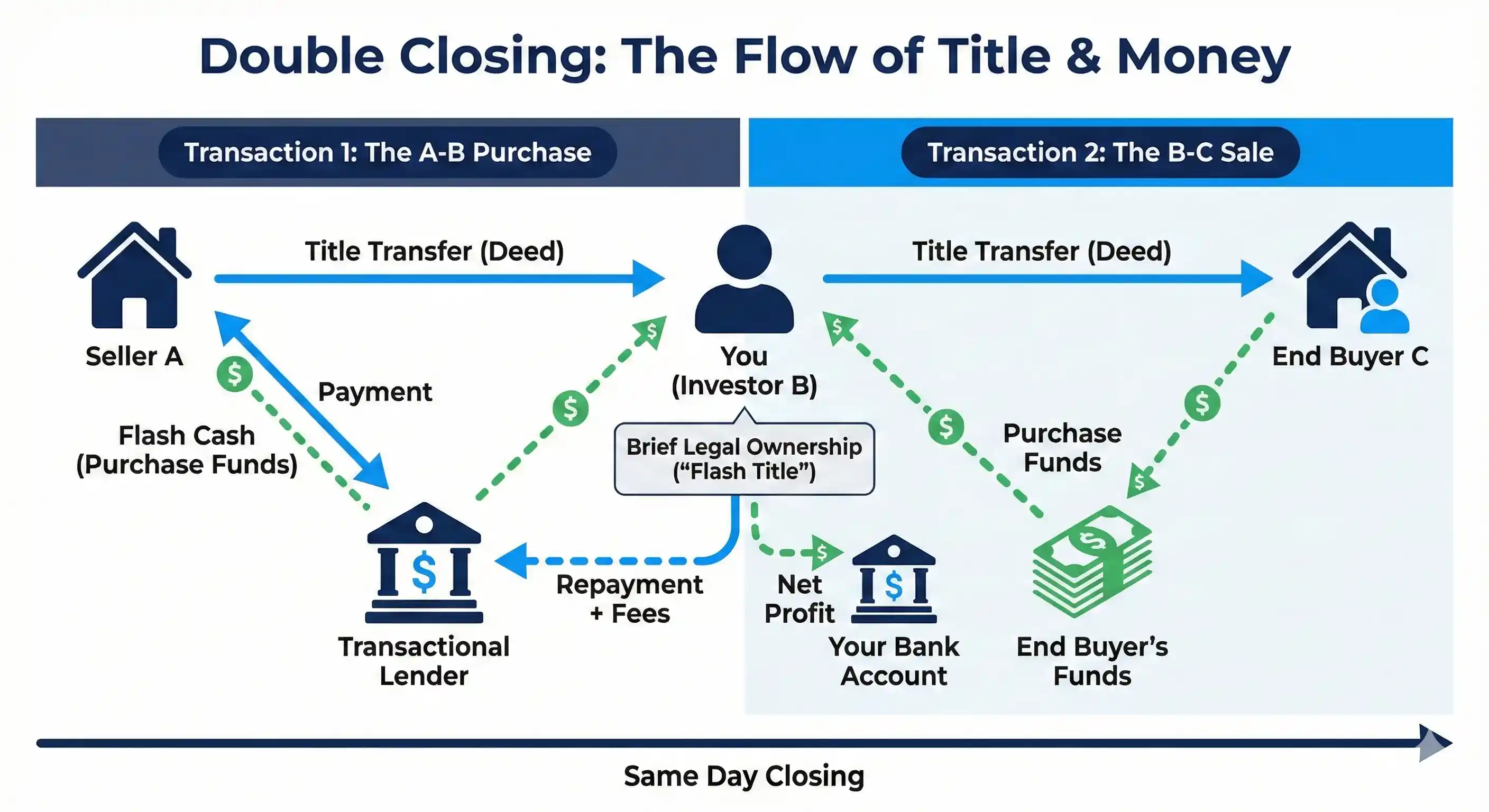

To understand the mechanics, you must view the deal as two distinct events involving three parties: The Seller (A), You (Investor B), and The End Buyer (C). This is often called the "A-B-C" transaction chain.

- Transaction 1 (The A-B Purchase): You (Investor B) enter a contract to buy the property from the Original Seller (A). You go to the closing table, sign the buying documents, and the deed is transferred to your company. For a brief moment, you are the legal owner of record.

- Transaction 2 (The B-C Sale): Moments later—sometimes at the same table—you (Investor B) sell that same property to your End Buyer (C). You sign the selling documents, and the deed is transferred from your company to the end buyer.

The magic of this strategy is the "Flash Title." You might only hold the title for 20 minutes, but because you technically owned the property, you are the principal in the second transaction. This means you do not need to disclose your purchase price to the end buyer, and you do not need to disclose your sale price to the original seller.

In a standard wholesale deal using an Assignment of Contract, you are not selling the property. You are selling the rights to the contract. The end buyer steps into your shoes and closes directly with the original seller. This is simple and cheap, but it exposes your profit margin to everyone involved in the HUD-1 settlement statement.

A double close separates these events into two distinct timelines, protecting your fee.

Double Closing vs. Assignment of Contract

Most beginners default to assignments because they are cheaper. However, experienced investors use double closings to protect massive spreads. Here is the breakdown:

| Feature | Assignment of Contract | Double Closing |

|---|---|---|

| Privacy | Zero. Seller sees your fee on the HUD-1. | 100%. Seller only sees the purchase price. |

| Closing Costs | Paid once (usually by End Buyer). | Paid twice (You pay A-B costs). |

| Funding Required | None. Buyer's funds cover the deal. | Yes. You must fund the A-B purchase. |

| Complexity | Low. One set of closing docs. | High. Two sets of docs + lender coordination. |

The Fast Track: Why You Need A Proven System

Here is the hard truth about Double Closings:

You are paying closing costs twice. This costs thousands of dollars.

If you buy a property off the MLS at market value, you cannot afford to double close. The math simply will not work.

To make this model work, you must buy at a steep discount.

We use a specific strategy to find distressed assets that have enough equity to cover two sets of closing costs and still leave you with a massive profit.

If you want the exact marketing scripts, deal analysis calculators, and negotiation tactics we use to find these hidden deals, you need our Ultimate Guide to Start Real Estate Investing. It is the blueprint for finding the deal before you place the tenant.

How To Double Close In 7 Steps (The Logistics)

Executing a simultaneous closing requires precision. Unlike a standard purchase, where you have 30 days to figure things out, a double closing happens in a matter of hours. One mistake in the A-B transaction will immediately derail the B-C transaction.

Follow this exact workflow to ensure both sides of the deal fund successfully:

- Step 1: Find The Right Deal

- Step 2: Run The Numbers

- Step 3: Get It Under Contract

- Step 4: Find The End Buyer

- Step 5: Secure Transactional Funding

- Step 6: Open Escrow

- Step 7: Execute The Double Close

Step 1: Find The Right Deal (Deep Discount Required)

The math is the hardest part of this strategy. Because you are paying closing costs on the purchase and potentially on the sale, your spread needs to be significant.

You cannot double close a property you picked up at 90% of market value. There isn't enough meat on the bone. You need to target off-market properties—distressed homes, pre-foreclosures, or tired landlords—where you can acquire the asset for 70% of the After Repair Value (ARV) minus repairs.

The "Margin Squeeze": In a standard assignment, a $5,000 fee is a win. In a double close, a $5,000 spread is a loss. After paying $2,000 in closing costs on the buy-side, $1,500 in transactional funding fees, and $2,000 in closing costs on the sell-side, you would actually lose money.

Rule of Thumb: If your projected gross profit is less than $10,000, do not double close. Stick to assigning the contract.

Step 2: Run The Numbers (The "Double Cost" Trap)

Before you make an offer, you must calculate the costs for both transactions. Beginners often forget that in the A-B transaction, they are the buyer, meaning they are responsible for the buyer's closing costs.

| Expense Category | Estimated Cost | Description |

|---|---|---|

| A-B Closing Costs | $1,500 - $3,000+ | Title insurance, escrow fees, recording fees, and transfer taxes (state dependent). |

| Transactional Funding | 1% - 2.5% of Loan | The fee to borrow the flash cash for 24 hours. Often includes a $495+ processing fee. |

| B-C Closing Costs | Variable | In some markets, you pay for the owner's title policy for your end buyer. |

Step 3: Get It Under Contract (The A-B Side)

Once the numbers make sense, sign a Purchase and Sale Agreement with the seller. This creates your "equitable interest" in the property.

Contrary to popular belief, you do not need an "And/Or Assigns" clause for a double close because you are not assigning the contract; you are fulfilling it. You are buying the house.

Pro Tip: The Inspection Period Lifeline

- The Risk: If you sign a contract and cannot find a buyer, you risk losing your Earnest Money Deposit (EMD).

- The Fix: Always include a 10-14 day inspection period in your A-B contract. This gives you a "free look" to find an end buyer. If you can't find one by day 10, you can cancel the contract legally and get your EMD back.

Step 4: Find The End Buyer (Cash or Hard Money Only)

You need to find a buyer who is willing to purchase the property from you for a higher price. Speed is the priority here.

The Deal Killer: You generally cannot sell to a retail buyer using an FHA or conventional mortgage. Most FHA loans have a "90-day seasoning rule," meaning the seller (you) must own the property for at least 90 days before reselling it. Since you are owning it for 5 minutes, the deal will be flagged and denied by the buyer's lender.

Target These Buyers:

- Cash Buyers: The gold standard. No banks, no seasoning, no delays.

- Hard Money Borrowers: Most hard money lenders understand double closings and will fund the deal as long as the asset value supports it.

Step 5: Secure Transactional Funding

Since you are technically buying the property from the original seller, you must have the funds to close. You cannot use the end buyer's money to fund your purchase (we will explain why in the "Wet vs. Dry" section below).

You need "Transactional Funding" (also known as Flash Cash). This is a short-term bridge loan that exists solely for the duration of the closing—usually less than 24 hours.

What The Lender Needs From You:

- Executed A-B Contract (Purchase).

- Executed B-C Contract (Resale).

- Corporate Documents (LLC Operating Agreement and EIN).

- Valid Photo ID.

Step 6: Open Escrow with an Investor-Friendly Title Company

This is the most critical step in the logistics chain. You cannot take a double closing to a standard title company or closing attorney. Most will look at the structure, get confused, and tell you it is illegal or impossible.

Script: Vetting Your Title Company

- You: "Hi, I am a real estate investor. I have a double closing transaction coming up funded by transactional funding. Do you handle simultaneous closings?"

- If they say: "What is that?" or "We need the first deed recorded before we can close the second..."

- You say: "Thank you for your time," and hang up.

- If they say: "Yes, we do these all the time. Send over the contracts." → You have found your partner.

The title company will open two separate files:

- File #1: Seller A to Investor B.

- File #2: Investor B to Buyer C.

Step 7: Execute The Double Close

On closing day, the timing is choreographed carefully:

- 09:00 AM: Your End Buyer (C) wires their funds to the title company. This proves the exit strategy is secure.

- 10:00 AM: Your Transactional Lender sees that Buyer C's funds have arrived and wires the funds for your purchase (A-B).

- 11:00 AM: The title company funds the A-B transaction. The seller gets paid. You technically own the home.

- 01:00 PM: The title company funds the B-C transaction using Buyer C's money. The transactional lender gets repaid plus their fee, and the difference (your profit) is wired to your bank account.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

Transactional Funding: The Fuel (Wet vs. Dry)

The biggest misconception about double closing is that you can simply use the end buyer's money to fund your purchase from the original seller. Ten years ago, title companies would sometimes allow this. It was called a "Dry Closing."

Today, in almost every state, that practice is considered mortgage fraud or a violation of insurance regulations.

To understand why you need money, you must understand the difference between Wet Funding and Dry Funding.

The "Old Way" (Dry Funding)

In a Dry Closing, the title company would take the $250,000 from Buyer C, move it into the A-B file, and use it to pay Seller A. Investor B (you) never actually brought any money to the table.

This is now widely prohibited because you cannot sell something you do not own. If you use C's money to buy A's house, you are technically using funds that don't belong to you to acquire an asset. Most title insurance underwriters will not insure this transaction.

The "New Way" (Wet Funding)

To double close legally in 2026, you must use Wet Funding. This means you must bring "good funds" to the closing table for the A-B transaction. The money must effectively "hit" the escrow account.

Since most wholesalers do not have $200,000 sitting in their bank account, they use Transactional Funding (often called Flash Cash or a 1-Day Bridge Loan). The lender wires the money into escrow on your behalf, you take title, and then you immediately resell the property to Buyer C, paying back the lender from the proceeds.

Pro Tip: The Proof of Funds Strategy

- Get It Early: Do not wait until closing day to find a lender. You should establish a relationship with a transactional lender before you make offers.

- The Letter: Most transactional lenders will provide you with a generic "Proof of Funds" (POF) letter for free. Submit this letter with your offer to Seller A. It proves you have the cash to close, making your offer 10x stronger than a standard wholesaler's contract.

The Cost of "Flash Cash"

Transactional funding is expensive if you look at the APR, but cheap if you look at it as a transaction fee. Lenders typically charge:

- Points: 1% to 2.5% of the loan amount (e.g., $2,000 on a $100k loan).

- Processing Fee: $400 to $900 per transaction.

- Credit Check: None. These are asset-based loans. If you have a signed contract with an End Buyer (C), you qualify.

$240,000 (Sale Price to Buyer C) – $200,000 (Purchase Price from Seller A) – $4,000 (A-B & B-C Closing Costs) – $3,500 (Funding Fee @ 1.75%) = $32,500 (Net Profit)

When Should You Double Close? (Pros & Cons)

Double closing is a tool, not a lifestyle. You should not use it for every single transaction. It is more expensive and more complex than a standard assignment. However, in specific scenarios, it is the only way to get the deal done legally and profitably.

Here is the decision framework experienced investors use to choose between an assignment and a double close.

The Advantages (When To Use It)

- Total Privacy: This is the primary benefit. If you are making a $50,000 spread on a $150,000 house, the seller will likely blow up the deal if they see your assignment fee. Double closing hides this spread entirely because the seller only sees the sale price, not your resale price.

- Bypassing Assignment Restrictions: Many institutional sellers, such as banks and government agencies, prohibit assignments. Bank-owned properties (REOs), HUD homes, and short sales typically include clauses in their addenda that explicitly ban assigning the contract. Since a double close involves you actually purchasing the title, it bypasses these "non-assignable" restrictions legally.

- Protecting Future Leads: If you are wholesaling in a small market, you don't want a reputation for "gouging" sellers. Keeping your profits private helps maintain relationships with real estate agents and sellers who might bring you future deals.

The Disadvantages (When To Avoid It)

- Higher Costs: You are paying closing costs twice (once when you buy, once when you sell). You are also paying lender fees. This can easily total $3,000 to $5,000 or more, which comes directly out of your pocket.

- Logistical Drag: Coordination is difficult. You need signatures from the seller, the buyer, the lender, and the title company, all within a tight window. If one document is missing, the entire chain freezes.

The $10k Rule

- Do Not Double Close For Peanuts: As a general rule, only use a double close if your gross profit is greater than $10,000 or if you are dealing with a non-assignable contract.

- If your spread is only $5,000, the closing costs and funding fees will eat over 50% of your profit. In those cases, stick to an assignment or renegotiate the deal.

Is Double Closing Legal? (2026 State Updates)

The short answer is yes. Double closing is legal in all 50 states.

Because you are actually taking title to the property—even if only for a few hours—you are acting as a principal in the transaction. You are buying a house, and then you are selling a house. Buying and selling real estate is a fundamental right of property ownership.

However, the "Wild West" days of unregulated investing are ending. New wholesaling laws 2026 are targeting investors who market properties they do not own. While double closing is often the safer alternative to assigning contracts, you must be aware of specific state regulations that treat "marketing" as a licensed activity.

Here are the specific battleground states you need to watch:

- Illinois: The state passed amendments to the Real Estate License Act defining "wholesaling" as a licensed activity. If you wholesale more than one deal in a 12-month period, you must hold a real estate license. This applies even if you double close, as the act of "marketing" the property to an end buyer before you hold the deed is considered brokering.

- Oklahoma: The "Predatory Real Estate Wholesaler Prohibition Act" is now in effect. It requires wholesalers to obtain a license and creates strict disclosure requirements. You must disclose specifically that you do not hold the legal title yet and that you are marketing an equitable interest.

- South Carolina: This state has taken an aggressive stance. The Real Estate Commission views marketing a property without a license as illegal brokering. Even if you plan to double close, you cannot publicly market a property (put it on Facebook, Zillow, or Craigslist) unless you own it. You must stick to private buyers' lists to stay compliant.

- Ohio: Ohio laws require you to disclose that you are a "principal" in the transaction. You cannot represent yourself as a middleman or an agent. You must clearly state in your contracts and marketing that you are the buyer in the first transaction and the seller in the second.

The Bottom Line: In these strict states, double closing is safer than assigning contracts because it proves intent to purchase. However, the safest route in regulated markets is to get your license or partner with a licensed agent.

Frequently Asked Questions on Double Closings

Here are the answers to the most common questions investors ask about simultaneous closings and transactional funding.

Final Thoughts: Privacy Is Worth The Price

Double closing is the advanced maneuver of the wholesaling world. It requires more capital, more coordination, and a deeper understanding of the laws than a simple assignment. But the payoff is worth it.

It allows you to take down six-figure spreads without the seller ever knowing. It allows you to flip bank-owned properties that other wholesalers ignore. It is a tool that separates the amateurs from the pros.

However, none of this works if you don't have the deal. You can have the best transactional lender in the world, but if you are buying at retail prices, you will lose money every time.

Double Closing protects your fee, but only if the deal is deep enough. If you buy at retail prices, you can't afford to pay closing costs twice. You need off-market inventory with massive equity.

Our FREE Training reveals the exact marketing system we use to find the deep-discount properties that make these back-to-back transactions possible. Stop relying on thin deals.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.